The Union Budget 2026 presents a clear roadmap for India’s journey towards Viksit Bharat. It combines high economic growth with inclusive and people-centric development. It is built on reform, youth empowerment, infrastructure expansion, and fiscal discipline. The Budget outlines key pillars such as manufacturing growth, MSME support, services sector expansion, agricultural productivity, trust-based governance, and ease of doing business.

This article provides a complete, exam-oriented analysis of the features of Union Budget 2026. It is highly relevant for UPSC, APSC, APPSC, and other competitive exam aspirants preparing Economy, Governance, Essay, and Interview topics.

India’s Economic Trajectory in Budget 2026:

To begin with, the Budget highlights India’s economic direction with a strong national vision:

Viksit Bharat: Ambition with Inclusion

The Budget promotes Viksit Bharat by linking growth with equity. It follows a clear policy mindset:

- Action over Ambivalence

- Reform over Rhetoric

- People over Populism

What is the Core Aim of the Union Budget 2026?

The Budget’s aim is straightforward and outcome-focused:

- Transform aspiration into achievement.

- Convert potential into performance.

As a result, the Budget positions itself as a bridge between national goals and real delivery on the ground.

Yuva Shakti–Driven Budget and Government’s Sankalp:

Next, the Budget strongly presents itself as a Yuva Shakti-driven Budget. It places youth energy at the centre of development and job creation.

At the same time, the government’s “Sankalp” remains focused on:

- The poor

- The underprivileged

- The disadvantaged

Therefore, the Budget tries to ensure that growth does not stay limited to a few, but reaches the wider population.

The 3 Kartavyas of Union Budget 2026–27:

The Budget clearly defines three Kartavyas, which act like a national roadmap.

1) Accelerate and Sustain Economic Growth:

First of all, the Budget aims to accelerate and sustain growth by:

- Enhancing productivity and competitiveness.

- Building resilience to volatile global dynamics.

This approach matters because global supply chains and trade conditions are uncertain, and India wants to stay stable and strong.

2) Fulfil Aspirations of Our People:

Secondly, the Budget focuses on people’s aspirations. It targets:

- Building people’s capacity

- Making people strong partners in India’s path to prosperity

In other words, it treats citizens not just as beneficiaries, but as active contributors.

3) Vision of Sabka Saath, Sabka Vikas:

Finally, the Budget strengthens Sabka Saath, Sabka Vikas by ensuring:

- Every family, community, region, and sector get access to resources, amenities and opportunities for meaningful participation.

India’s Reform Express: The Reform Momentum Continues

Moreover, the Budget highlights India’s fast-paced reform journey through the idea of India’s Reform Express.

Key points mentioned:

- The government has undertaken comprehensive economic reforms to create employment, boost productivity, and accelerate growth.

- Over 350 reforms have been rolled out, including:

- GST simplification

- notification of Labour Codes

- rationalisation of mandatory Quality Control Orders

- The government has formed High Level Committees.

- The Central Government is working with State Governments on:

- deregulation

- reducing compliance requirements

Thus, the Budget clearly pushes reforms that reduce friction and improve economic performance.

What are the Key Features of the Union Budget, 2026-27?

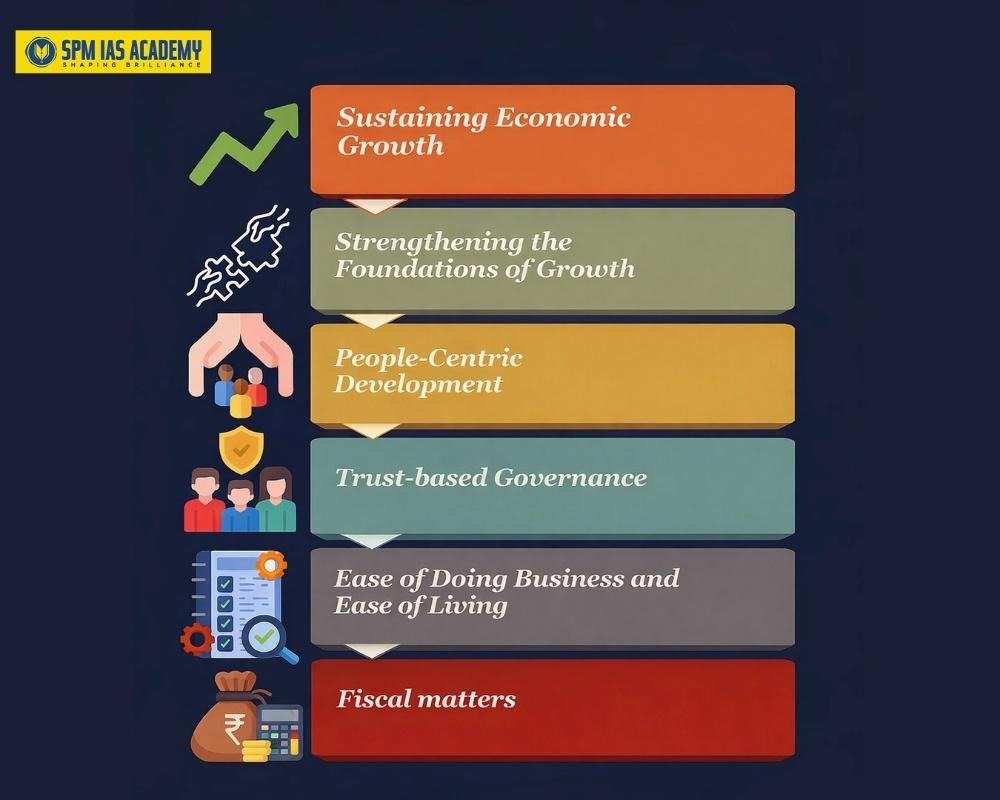

Pillars of Growth and Development in Budget 2026:

The Budget is structured around the following key pillars:

Below is the detailed explanation of each pillar based strictly on the given text.

1) Sustaining Economic Growth:

1.1 Manufacturing Push: Strategic and Frontier Sectors

To start with, the Budget supports manufacturing through targeted policy and tax measures.

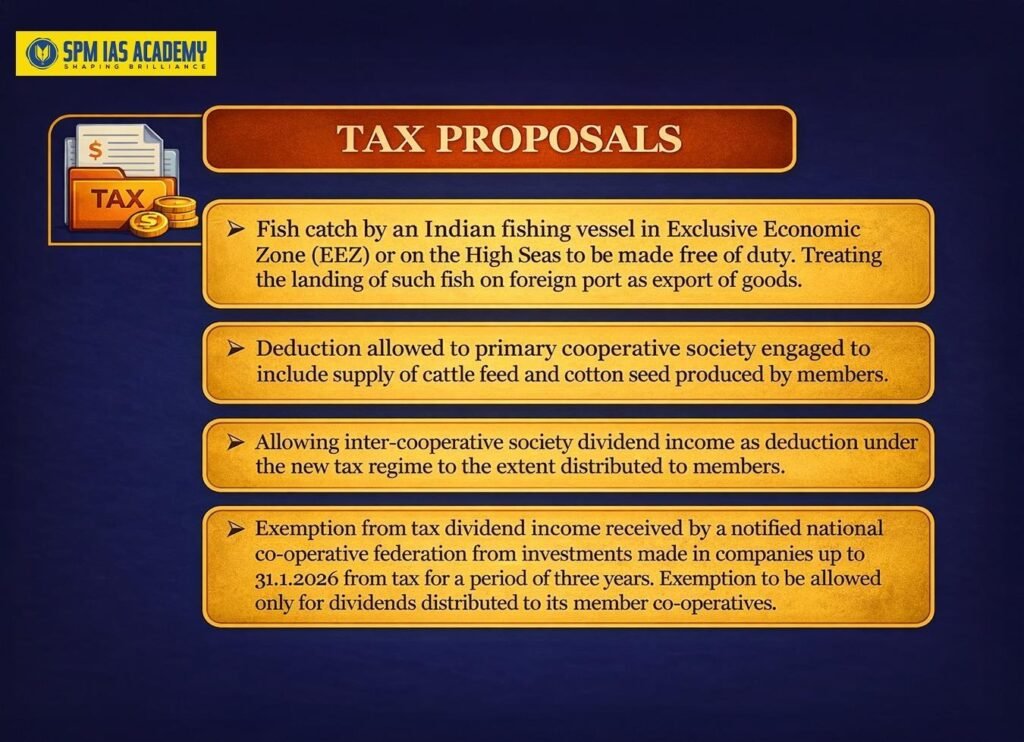

Tax and Customs Reforms to Boost Manufacturing:

The Budget proposes several measures, especially around bonded zones, warehousing, exports, and trusted manufacturing systems:

- Income tax exemption for five years to non-residents providing capital goods, equipment, or tooling to any toll manufacturer in a bonded zone.

- Safe harbour provision to non-residents for component warehousing in a bonded warehouse.

- Deferred duty payment window to trusted manufacturers.

- Increase in limit for duty-free imports of specified inputs used for processing seafood exports from 1% to 3% of FOB value of the previous year’s export turnover.

- Duty-free imports of specified inputs extended to export of shoe uppers, in addition to leather or synthetic footwear.

- Extension of time for export of final product from 6 months to 1 year for exporters of:

- leather or textile garments

- leather and synthetic footwear

- Exemption from basic customs duty on specified parts used in manufacture of microwave ovens.

- Exemption from basic customs duty on components and parts used in aircraft manufacturing.

- Exemption from basic customs duty on raw materials imported for manufacture of aircraft parts used in maintenance, repair, or overhaul (MRO) requirements for defence units.

- Regular importers with trusted longstanding supply chains will be recognized in the risk system.

- Export cargo using electronic sealing will get clearance from factory premises to the ship.

- A special one-time measure to facilitate sale in domestic tariff area at concessional rate of duty by eligible manufacturing units of SEZs.

As a result, the Budget tries to reduce manufacturing costs, simplify exports, and improve supply chain trust.

MSMEs as ‘Champions’: Three-Pronged Growth Strategy

Just as importantly, the Budget positions MSMEs as “Champions” and supports them with a three-part approach:

A) Equity Support:

- Dedicated ₹10,000 crore SME Growth Fund.

- Top up the Self-Reliant India Fund (2021) with ₹2,000 crore.

B) Professional Support:

- Government will facilitate Professional Institutions to develop “Corporate Mitras”, especially in Tier-II and Tier-III towns.

- Corporate Mitras will help MSMEs meet compliance requirements at affordable costs.

C) Liquidity Support through TReDS:

- Mandate TReDS as the transaction settlement platform for all purchases from MSMEs by CPSEs, setting a benchmark for other corporates.

- Introduce credit guarantee support through CGTMSE for invoice discounting on TReDS.

- Link GeM with TReDS to encourage cheaper and quicker financing.

- Enable TReDS receivables as asset-backed securities to build a secondary market and enhance liquidity and settlement.

Therefore, MSMEs get stronger capital access, better compliance support, and faster working capital cycles.

1.2 Renewed Emphasis on the Services Sector:

The Budget also expands the services economy and supports new employment areas.

Services Sector Governance:

- High-Powered “Education to Employment and Enterprise” Standing Committee to focus on services sector as a core driver of Viksit Bharat.

Health and Care Economy:

- Upgrade and establish new institutions for Allied Health Professionals (AHPs) in 10 selected disciplines.

- Develop NSQF-aligned programmes to train 1.5 lakh multi-skilled caregivers.

Medical Tourism:

- Schemes to support states in establishing Five Hubs for Medical Value Tourism with private sector partnership.

AYUSH Expansion:

- 3 new All India Institutes of Ayurveda.

- Upgrade AYUSH pharmacies and drug testing labs for higher certification standards.

- Upgrade the WHO Global Traditional Medicine Centre.

Orange Economy and AVGC:

- Set up AVGC Content Creator Labs in 15,000 secondary schools and 500 colleges.

Design and Innovation:

- Set up a new National Institute of Design through the challenge route in the eastern region of India.

Sports (Khelo India Mission):

- Integrated talent development pathway

- Systematic coaching development

- Integration of science and technology

- Development of sports infrastructure

Education Push:

- 5 University Townships near major industrial and logistic corridors.

- A girls’ hostel in Higher Education STEM institutions in every district.

- Set up or upgrade four Telescope Infrastructure facilities.

Tourism Expansion:

- Set up a National Institute of Hospitality to bridge academia, industry, and government.

- Pilot scheme to upskill 10,000 guides across 20 iconic tourist sites.

- National Destination Digital Knowledge Grid to digitally document places of significance.

- Develop ecologically sustainable mountain trails, turtle trails and bird watching trails.

- India to host the first ever Global Big Cat Summit.

- Develop 15 archaeological sites into vibrant cultural destinations.

- Develop Buddhist Circuits in North East Region.

Financial Sector Reforms and New Institutions:

The Budget also supports India’s financial system and capital market depth.

Key announcements include:

- Set up a High Level Committee on Banking for Viksit Bharat to align banking with India’s next growth phase.

- Incentive of ₹100 crore for single issuance of municipal bonds above ₹1000 crore.

- AMRUT municipal bond scheme continues.

- Restructuring:

- Power Finance Corporation (PFC)

- Rural Electrification Corporation (REC)

- Comprehensive review of FEMA (Non debt Instruments) Rules.

- Introduction of Market making framework and Total return swaps on corporate bonds.

As a result, the Budget pushes cleaner regulation and deeper bond markets.

1.3 Increasing Farmers’ Income by Enhancing Productivity:

The Budget gives strong support to agriculture and allied sectors with clear productivity goals.

Horticulture Programme:

- Rejuvenate old, low-yielding orchards

- Expand high-density cultivation of walnuts, almonds and pine nuts.

Animal Husbandry:

- Support entrepreneurship for job creation in rural and peri-urban areas.

- Loan-linked capital subsidy support for private sector establishment of:

- veterinary and para-vet colleges

- veterinary hospitals

- diagnostic labs

- breeding facilities

High Value Agriculture:

- Coconut promotion scheme to increase production and productivity.

- Indian Cashew & Cocoa Programmes.

Dedicated Programme for Indian cashew and cocoa:

- It will aim to boost engagement and relevance by training employees.

Fisheries:

- Integrated development of 500 reservoirs and Amrit Sarovars.

- Strengthen fisheries value chain in coastal areas.

- Enable market linkages for start-ups and women-led groups with Fish FPOs.

Sandalwood:

- Focused cultivation and post-harvest processing.

Bharat VISTAAR:

- Integrate AgriStack portals and ICAR package on agricultural practices with AI systems.

Therefore, the Budget shifts agriculture from low productivity to value-driven, tech-supported growth.

2) Strengthening the Foundations of Growth:

2.1 Infrastructure Push:

Infrastructure is a core foundation of economic growth in Budget 2026–27. Key measures include:

- Set up Infrastructure Risk Guarantee Fund to provide calibrated partial credit guarantees to lenders.

- Recycle real estate assets of CPSEs through dedicated REITs.

- Establish new Dedicated Freight Corridors connecting Dankuni (East) to Surat (West).

- Operationalise 20 new National Waterways connecting mineral-rich areas, industrial centres, and ports.

- Set up a ship repair ecosystem for inland waterways.

- Launch Coastal Cargo Promotion Scheme to increase the share of inland waterways and coastal shipping from 6% to 12% by 2047.

- Launch Seaplane VGF Scheme to indigenise manufacturing.

- Provide ₹2 lakh crore support to states under SASCI Scheme.

- Purvodaya: Development of Integrated East Coast Industrial Corridor.

This section is very important for UPSC economy and infrastructure questions.

2.2 Ensuring Long-Term Energy Security and Stability:

The Budget includes a dedicated focus area on:

- long-term energy security

- stability in energy systems

This theme fits strongly with GS Paper 3 topics like energy transition and sustainable growth.

2.3 Urbanisation: City Economic Regions:

The Budget promotes City Economic Regions to unlock urban productivity.

Key focus points:

- Amplify the potential of cities as economic agglomerations.

- Focus on Tier II, Tier III cities, and temple-towns.

‘Growth Connectors’: High-Speed Rail Corridors:

The Budget proposes 7 high-speed rail corridors as environmentally sustainable passenger systems:

- Mumbai–Pune

- Pune–Hyderabad

- Hyderabad–Bengaluru

- Hyderabad–Chennai

- Chennai–Bengaluru

- Delhi–Varanasi

- Varanasi–Siliguri

These corridors are high-value current affairs for essays and economy answers.

3) People-Centric Development:

The Budget includes People-Centric Development as a pillar. It provides for:

- Strong care ecosystem covering geriatric and allied care services.

- Self-Help Entrepreneurs (SHE) Marts to be set up as community owned retail outlets.

- Divyangjan Kaushal Yojana – aims to provide dignified livelihood opportunities to disabled persons through industry-relevant training.

- Divyang Sahara Yojana – timely access to high-quality assistive devices for all eligible.

- Supporting Artificial Limbs Manufacturing Corporation of India to scale up production of assistive devices invest in R&D and AI integration.

- Strengthen PM Divyasha Kendras as modern retail-style centres.

- Setting up NIMHANS – 2 and upgrading National Mental Health Institutes in Ranchi & Tezpur.

- Establishing Emergency and Trauma Care Centres in district hospitals.

This aligns with “fulfilling aspirations” and making citizens partners in growth.

4) Trust-Based Governance:

- Firstly, the government extends duty deferral for AEOs: The Budget increases the duty-deferral period for Tier-2 and Tier-3 Authorised Economic Operators (AEOs) from 15 to 30 days. It grants the same facility to eligible manufacturer-importers, thereby strengthening trade facilitation and trusted trader programs.

- Secondly, the government enhances certainty through advance rulings: It extends the validity of advance rulings binding on Customs from 3 years to 5 years. It will improve policy predictability, investor confidence, and ease of doing business.

- Moreover, Customs recognises trusted supply chains: Customs will identify regular importers with long-standing, reliable supply chains within the risk management system. Thus, it will reduce repeated cargo verification and expediting customs clearance.

- Additionally, for trusted importers, the filing of the Bill of Entry and arrival of goods will automatically trigger Customs notifications, which speeds up import processing and logistics efficiency.

- Finally, the government reforms customs warehousing. It transforms the Customs warehousing framework into a warehouse-operator-centric system with self-declarations, simplifying compliance, digital governance, and trade operations.

5) Ease of Doing Business and Ease of Living: Major Tax and Compliance Changes

This is one of the most detailed and exam-relevant parts of the Budget.

Key Tax and Compliance Proposals:

- PROIs (Individuals Resident Outside India) permitted to invest in equity instruments of listed Indian companies through Portfolio Investment Scheme (PIS).

- Interest awarded by motor accident claim tribunal to a natural person exempt from Income Tax; TDS removed.

- Reduce TCS rate on overseas tour program package from 5% and 20% to 2%, without amount stipulation.

- Reduce TCS for education and medical purposes under Liberalized Remittance Scheme (LRS) from 5% to 2%.

- TDS on supply of manpower services at either 1% or 2%.

- Lower or nil deduction certificate via rule-based automated process for small taxpayers.

- Enable depositories to accept Form 15G/15H for taxpayers holding securities in multiple companies.

- Extend time for revising returns from 31 Dec to 31 March with nominal fee.

- ITR 1 and ITR 2 continue till 31 July; non-audit business cases or trusts proposed till 31 August.

- TDS on sale of immovable property by a non-resident deducted using resident buyer’s PAN instead of TAN.

- One-time 6-month foreign asset disclosure scheme below certain size for small taxpayers.

- Allow return update even after reassessment begins with additional 10% tax rate over applicable rate.

- Immunity framework from penalty and prosecution extended from underreporting to misreporting.

- Decriminalise non-production of books and documents and requirement of TDS payment.

- Immunity from prosecution with retrospective effect from 1.10.2024 for non-disclosure of non-immovable foreign assets under ₹20 lakh.

- Exempt MAT to all non-residents paying tax on presumptive basis.

- Joint Committee of MCA and CBDT to incorporate ICDS requirements in IndAS.

- Tax buyback for all shareholders as capital gains; promoters pay additional buyback tax.

- MAT credit set-off allowed up to 1/4th of tax liability in the new regime.

- MAT proposed to be made final tax.

- Exempt BCD on 17 cancer drugs/medicines.

- Single and interconnected digital window for cargo clearance approvals.

- Customs Integrated System (CIS) rollout in 2 years.

- Dispute settlement: honest taxpayers can close cases by paying additional amount in lieu of penalty.

As a result, the Budget pushes a smoother compliance environment with technology-driven clearances.

6) Fiscal Matters: Finance Commission and Fiscal Consolidation:

16th Finance Commission Highlights:

- The government accepted recommendations to retain a vertical share of devolution at 41%.

- Provision of ₹1.4 lakh crore to states for FY 27 as Finance Commission Grants:

- Rural and Urban Local Body grants.

- Disaster Management grants.

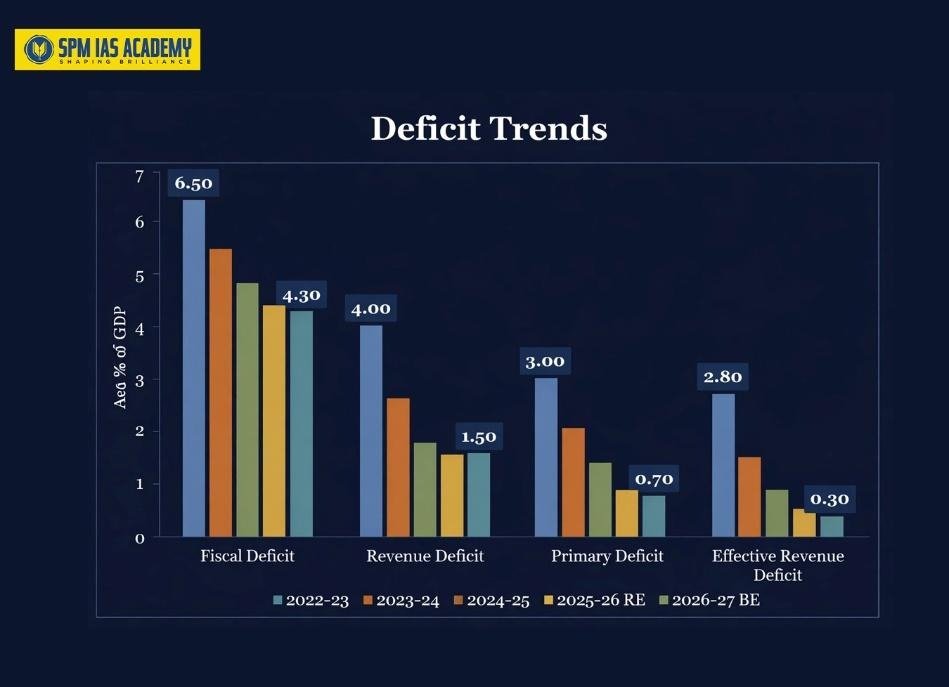

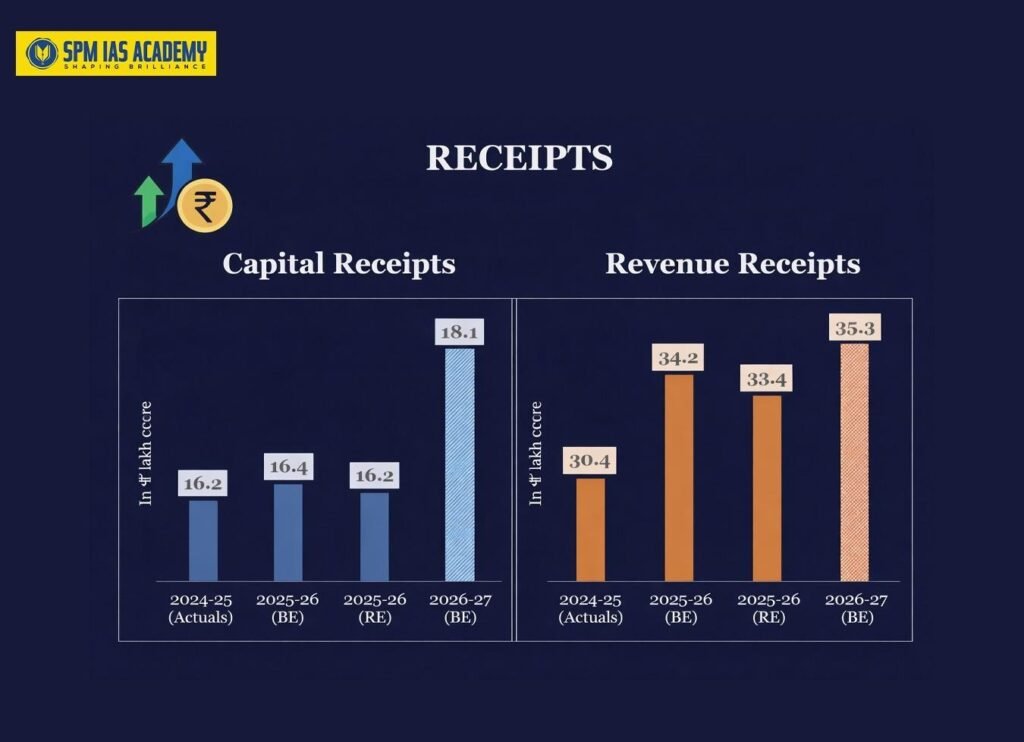

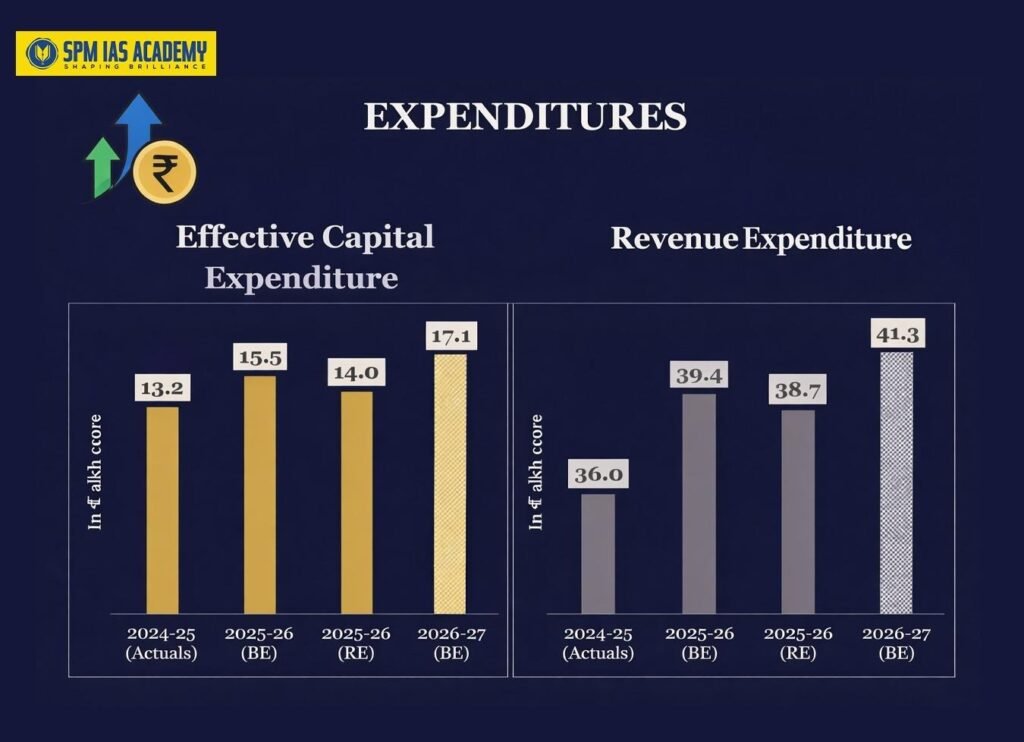

Fiscal Consolidation Targets:

- Target debt-to-GDP ratio of 50±1% by 2030.

- Debt-to-GDP estimated at 55.6% in BE 2026–27 as compared to 56.1% in RE 2025–26.

- Fiscal deficit:

- 4.4% of GDP in RE 2025–26 (same as BE 2025–26)

- 4.3% of GDP in BE 2026–27

Therefore, the Budget signals fiscal discipline while still supporting growth.

Conclusion: What Union Budget 2026–27 Signals

Union Budget 2026–27 delivers a clear message i.e. India wants fast growth with fairness, powered by youth energy, supported by reforms, and protected by fiscal prudence. It strengthens manufacturing and MSMEs, expands services and tourism, modernises agriculture with AI integration, boosts infrastructure and logistics, and improves compliance through trust-based governance.

For UPSC, APSC, APPSC, and other competitive exam aspirants, this Budget is not just current affairs but it is a complete framework for writing stronger answers.

Source:

https://www.indiabudget.gov.in

The key features of Union Budget 2026–27 include the Viksit Bharat vision, Yuva Shakti focus, three Kartavyas, strong push to manufacturing and MSMEs. Moreover, it includes services sector expansion, agricultural productivity enhancement, infrastructure development, trust-based governance, and fiscal consolidation.

Union Budget 2026–27 is important for UPSC, APSC, and APPSC because it directly relates to GS Paper 3 (Economy), GS Paper 2 (Governance), essay themes, and interview questions on reforms, fiscal policy, infrastructure, and inclusive growth.

The Three Kartavyas of Union Budget 2026–27 are: accelerating and sustaining economic growth, fulfilling the aspirations of the people through capacity building, and ensuring Sabka Saath, Sabka Vikas with inclusive access to opportunities and resources.

The Budget supports MSMEs through a ₹10,000 crore SME Growth Fund, liquidity support via TReDS, and professional compliance support through Corporate Mitras. Furthermore, it also provides export-friendly tax reforms, thereby boosting employment and entrepreneurship.

In the Union Budget 2026–27, the fiscal deficit is targeted at 4.3% of GDP. Moreover, the government aims to achieve a debt-to-GDP ratio of 50±1% by 2030, ensuring fiscal discipline alongside economic growth.