India’s manufacturing growth faces a critical bottleneck in land acquisition. Fragmented records, multiple authorities, and unclear titles create costly delays that deter investors. The Confederation of Indian Industry has proposed comprehensive reforms. These include a GST Council-like land coordination body and integrated state authorities. However, political consensus remains elusive.

Beyond land issues, pending reforms like the four labour codes further constrain India’s manufacturing potential. This is happening at a time when global supply chains are reshaping. As India aspires for Viksit Bharat 2047, reimagining the manufacturing sector is important. Market reforms have become a decisive economic imperative that cannot be delayed.

In this article, we will look into India’s manufacturing growth and its path to manufacturing excellence.

What are the Key Developments in the Growth of India’s Manufacturing Sector?

Below are the primary developments in India’s manufacturing growth:

1. Surge in Foreign Direct Investment (FDI)

India’s manufacturing sector has attracted a lot of foreign investment. This growth strengthens its role as a top destination for global investments.

a. The increase in foreign direct investment improves local competencies and introduces advanced technologies.

b. Foreign Direct Investment (FDI) in the manufacturing sector has amounted to USD 165.1 billion, representing a 69% rise over the last ten years.

- In the last 5 years, India’s manufacturing sector saw significant growth. It reported total FDI inflows of Rs. 33.58 lakh crore, which is equivalent to US$383.5 billion. This figure highlights strong confidence from global investors in the sector.

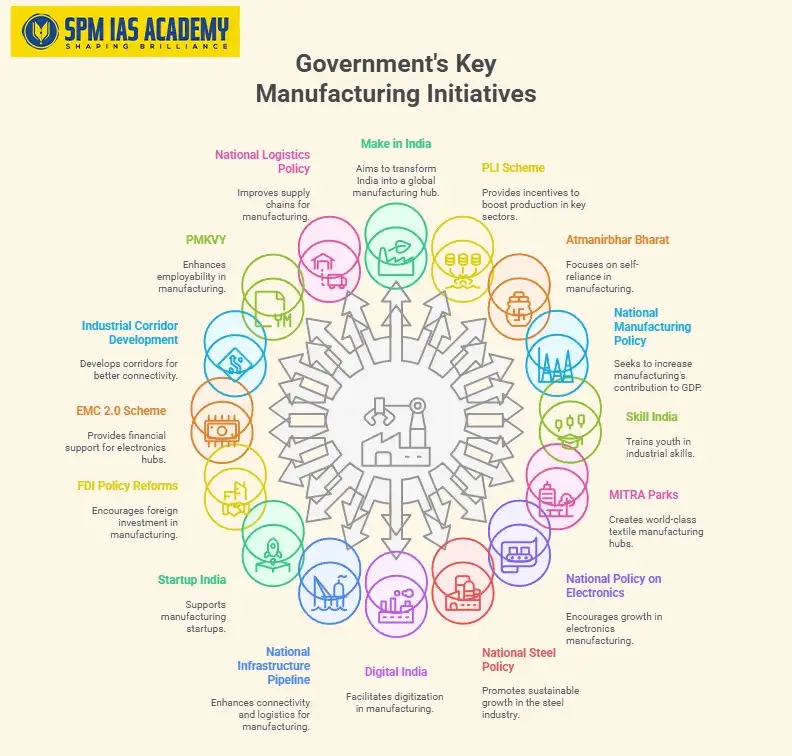

2. Robust Government Initiatives

The government is implementing proactive policies. One of these initiatives is “Make in India.” Another is the introduction of the Production-Linked Incentive Scheme. These efforts are actively fostering growth in key sectors.

a. These policies are encouraging international firms to set up manufacturing centers in India. This will help decrease reliance on imports.

b. The PLI scheme has attracted major players like Apple. As a result, smartphone exports surged by 42% in FY24. They reached Rs. 1.36 lakh crore, equivalent to approximately US$15.6 billion. These efforts are expected to boost India’s export-driven growth in the years to come.

3. Digital Transformation in Manufacturing

The push towards Industry 4.0 is reshaping India’s manufacturing landscape. Automation and digital tools are driving efficiency.

a. The adoption of AI is increasing. IoT and robotics are also being adopted more widely. These technologies are improving production rates. They are also enhancing operational efficiency.

b. India’s manufacturing PMI for April 2025 stood at 58.2. This figure signals growth. The growth is driven by digital transformation.

- Moreover, India’s digital economy is projected to grow at twice the rate of the overall economy. This growth will further enhance its global competitiveness.

4. Growth in Exports and Market Diversification

India’s export landscape is diversifying. There has been a significant rise in non-petroleum goods. This increase is particularly evident in the pharmaceuticals, electronics, and chemical industries.

a. The total export value reached USD 820.93 billion in FY25. Notable contributions from the e-commerce and electronics sectors supported this achievement.

b. Merchandise (goods) exports, excluding petroleum products, reached an all-time high of USD 374.1 billion. This represents a 6% increase. The growth reflects the success of India’s manufacturing and export strategies under the Production-Linked Incentive (PLI) scheme.

5. Emerging Sunrise Sectors

India is making substantial strides in emerging sectors. These sectors include renewable energy components, medical devices, and semiconductors. This progress is positioning India as a leader in these high-growth industries.

a. The government’s emphasis on renewable energy and electronics production is starting to produce positive outcomes.

b. For example, India’s semiconductor market is projected to reach USD 63 billion by 2026. Increased investments in chip manufacturing drive this growth. Initiatives like the Rs. 76,000 crore Semicon India program are spurring this investment.

What are the Key Issues Related to India’s Manufacturing Growth Landscape?

1. Land Acquisition Bottlenecks

The land records are fragmented. There are unclear title issues. These problems continue to delay land acquisition for manufacturing facilities. As a result, sector growth is hindered.

a. The absence of a cohesive and efficient land acquisition process results in lengthy disputes and regulatory difficulties.

b. Finding political agreement continues to be challenging, as demonstrated by the unsuccessful 2015 land acquisition ordinance.

c. A prominent example is the Hyderabad Future City project. Land was acquired solely for the PharmaCity Project. However, this land is now facing legal challenges due to being repurposed. As a result, investors face significant delays and uncertainty.

2. Labour Reforms Delays

The implementation of India’s new labor codes is slow and piecemeal. This creates significant uncertainty for manufacturers.

a. The central government passed the reforms. However, they have yet to be fully implemented. Labor is a concurrent subject. This means that states are required to frame and notify their own rules.

b. For example, West Bengal and Lakshadweep have not released draft regulations in advance for any of the codes, whereas places like Delhi have only done this for the Code on Wages.

c. This inconsistency across states hinders the creation of a seamless, unified national labor market. It perpetuates the “inspector raj” mentality that the reforms were meant to abolish.

3. Infrastructure Gaps and Logistics Challenges

India has made progress in digital and physical infrastructure. However, key logistics and transport inefficiencies remain. These inefficiencies are major barriers.

a. The lack of efficient and integrated infrastructure hampers the smooth movement of goods. This issue affects production timelines.

b.The Economic Survey 2022-23 provided estimates on India’s logistics costs. These costs are notably high, ranging from 14% to 18% of Gross Domestic Product (GDP).

- However, recent estimates by the National Council of Applied Economic Research (NCAER) place them lower. They estimate the value to be between 7.8% and 8.9% of GDP for 2022-23. This reflects a significant improvement.

- They still stay just above the global standard of 8% of GDP.

c. These logistics deficits raise manufacturing costs by 20-30%. This significantly limits competitiveness against neighbors like Vietnam. Vietnam has superior systems that enhance its manufacturing efficiency.

4. Skilled Labour Shortage

India has a vast workforce. This is a demographic advantage. However, the effectiveness of this workforce is diminished by a severe skill mismatch.

a. The lack of formal technical training is a significant issue. There is a shortage of industry-specific skills, especially in advanced manufacturing. This makes it difficult for firms to adopt modern technologies. As a result, achieving productivity improvements is a challenging task.

b. Only 4.1% of India’s workforce, in the 15-59 age group, has formal technical training. This is a stark contrast to over 70% in countries like Germany and South Korea.

- In the automotive sector, the demand for skilled workers is high. However, training programs remain insufficient to meet the growing requirements.

5. Environmental Compliance Issues

Stricter environmental norms have increased compliance costs. This is especially true for high-pollution sectors. Industries like cement, chemicals, and textiles are particularly affected.

a. The textile industry alone accounts for about 20% of India’s industrial water pollution. It is facing growing enforcement of wastewater treatment and Zero Liquid Discharge norms.

b. In 2024, many small-scale dyeing units in Punjab’s Ludhiana cluster faced shutdowns. This was due to their failure to meet effluent standards. These incidents highlighted the compliance risk in the industry.

6. Supply Chain Fragmentation and Over-dependence on Imports

India’s manufacturing remains vulnerable. This vulnerability is due to fragmented supply chains. Additionally, there is a heavy dependence on imported raw materials and components.

a. This over-reliance exposes industries to global supply shocks. It also escalates input costs, which undermines production stability.

b. A significant portion of electronic components for India’s domestic production is imported. In fact, 60-75% of these components are sourced from other countries. This heavy reliance on imports is causing inflation in input costs. Additionally, it contributes to disruptions in the supply chain.

c. Local supplier fragmentation increases transaction costs. It also hampers scalability efforts.

7. Potential Impacts of US Tariffs on Indian Manufacturing Exports

The recent imposition of steep tariffs by the US poses a significant threat to key Indian manufacturing sectors. These tariffs raise the cost of Indian goods. As a result, Indian products become less competitive in the market.

a. This is particularly impactful for labor-intensive industries. These industries are highly dependent on the US market. The tariffs could lead to a loss of market share. This loss could be to competing nations.

b. A recent analysis was conducted by the Indian Council for Research on International Economic Relations (ICRIER). It found that almost 70% of Indian goods exports to the US are now exposed to a 50% tariff. This amounts to around $60.85 billion.

- Labor-intensive sectors, such as textiles and apparel, face significant disadvantages. This places them at a disadvantage in the market.

What Measures Can India Adopt to Enhance Its Manufacturing Sector?

1. Optimizing Land Use and Acquisition

India needs a National Industrial Land Bank 2.0. This bank should utilize GIS mapping. It should also incorporate blockchain technology for title verification.

a. Ready-made industrial corridors that have received prior approval should be established to minimize legal conflicts.

b. A single-window clearance system is necessary. It must ensure quick approvals. Additionally, it should provide transparent compensation.

- Rehabilitation packages should strike a balance between investor confidence and farmer welfare. Such reforms will create predictable access to land. They will also make the process litigation-free.

2. Streamlining Labor Regulations

Labour codes need to transition from being mere documents. They should focus on actual implementation. This requires a coordination system between the Centre and the States.

a. Incentives tied to reforms can encourage states to promptly announce outstanding regulations.

b. A Unified Labour Compliance Portal should digitise inspections and filings. This approach will help curb the inspector raj. It is essential to protect worker representation to avoid a ‘hire-and-fire’ perception. Striking this balance will create a fair, flexible, and modern labour market.

3. Enhancing Logistics and Connectivity

A National Integrated Logistics Grid is essential under PM Gati Shakti. It links roads, railways, ports, and air cargo.

a. Multimodal logistics parks and freight corridors can reduce delays and costs. AI-enabled tools are essential for route optimisation. They can also enhance inventory tracking. Additionally, smart warehousing will help modernise supply chains.

b. Special focus is needed on hinterland connectivity. This is essential for balanced industrial growth. Lower logistics costs will help make Indian manufacturing globally competitive.

4. Building a Future-Ready Workforce

A National Manufacturing Skills Mission should target Industry 4.0 skills. These include robotics, EV batteries, and green hydrogen. Dual apprenticeship models should be implemented. These models will combine classroom learning with factory exposure. This approach will help close the training gap.

a. Large companies should be encouraged to run training programs for small and medium-sized businesses (MSMEs).

b. AI platforms can connect employers with skilled workers right away. This will change India’s workforce from just having many workers to being truly competitive.

5. Integrating Sustainability into Manufacturing

India should not view green norms as hurdles. Instead, it should invest in Green Technology Parks. These parks can feature shared treatment plants and renewable energy units..

a. A Green Credit System can reward firms. It encourages them to adopt circular economy practices. AI-driven monitoring systems should replace outdated manual inspections. This change aims to reduce compliance costs.

b. MSMEs should receive subsidies for clean technologies. This support will help align manufacturing growth with global sustainability benchmarks.

6. Strengthening Domestic Supply Chains

India must develop domestic component ecosystems in key sectors such as electronics, semiconductors, and pharmaceuticals. It is essential to integrate MSMEs into Global Value Chains (GVCs). This can be achieved through targeted supplier development programs.

a. Tax benefits aimed at promoting backward integration can stimulate the domestic manufacturing of raw materials.

b. Maintaining strategic reserves of essential resources will minimize exposure to global disruptions.

c. Enhancing local supply chains will increase resilience and decrease reliance on imports.

7. Diversifying Global Market Access

India should diversify its trade partnerships. Free Trade Agreements with the EU, ASEAN, and Africa can help achieve this goal. This strategy aims to reduce dependency on the US.

a. Export industries must adopt global quality certifications. This will help them achieve better branding. As a result, they can enhance their competitiveness.

b. Export hubs should receive policy support. This will help them scale up high-value products. Such proactive diversification will protect India’s market share globally.

8. Digital Public Infrastructure for Manufacturing

India transformed finance with UPI. A similar digital manufacturing stack can be created for production units.

a. This may include interoperable platforms for supply chain traceability. It may also involve machine data and compliance monitoring. Such DPI can foster efficiency. It can also promote transparency and accountability.

Conclusion

India’s manufacturing growth depends on resolving the 3 Ms: Money, Materials, and Manpower. Money involves efficient land acquisition and financing. Materials refer to having reliable supply chains. Manpower entails flexible labor policies through pending reforms.

The convergence of global supply chain shifts and India’s demographic advantage creates a narrow window of opportunity. This situation demands immediate political will. Holistic reforms will enhance global competitiveness. Additionally, these reforms will generate large-scale employment. This will drive inclusive and resilient economic growth in the coming decade.