Why in the News?

- The Government of India introduced four labour codes to consolidate 29 central labour laws.

- These codes aim to simplify regulations, promote ease of doing business, and ensure workers’ welfare.

- Codes lay the foundation for a protected, future-ready workforce and resilient industries, boosting employment and driving labour reforms for Aatmanirbhar Bharat.

- Code aligns India’s labour ecosystem with global standards, ensuring social justice for all workers

Implementation of Four Labour Codes:

- In a historic decision, the Government of India has announced the implementation of these four Labour Codes:

- The Code on Wages, 2019,

- The Industrial Relations Code, 2020,

- The Code on Social Security, 2020 and

- The Occupational Safety, Health and Working Conditions Code, 2020

- It came into effect from 21st November 2025 and will rationalise 29 existing labour laws.

- By modernising labour regulations, this landmark move lays the foundation for a future-ready workforce and stronger, resilient industries driving labour reforms for Aatmanirbhar Bharat.

Background:

- The second National Commission on Labour had recommended to group the existing Labour Laws into four/ five Labour Codes on functional basis.

- Accordingly, the Ministry of Labour & Employment started the exercise to rationalize, simplify and amalgamate the relevant provisions of the labour laws in four codes.

- The four Labour Codes were enacted after the deliberations held in the tripartite meeting of the Government, employers’, industry representatives and various trade unions during 2015 to 2019.

- The Code on Wages, 2019 was notified on 8th August, 2019 and the remaining three Codes were notified on 29th September, 2020.

Why It Is Necessary:

The codification of 29 existing labour laws into four Labour Codes was undertaken to address long-standing challenges and make the system more efficient and contemporary.

- The codification aims to enhance ease of doing business, promote employment generation, ensure safety, health, social & wage security for every worker.

- To begin with, many labour laws in India were created between the 1930s and 1950s, when economic conditions were entirely different.

- Meanwhile, major global economies modernised and consolidated their labour rules, but India continued relying on 29 scattered and outdated Central laws.

- As a result, these fragmented laws failed to keep pace with new economic realities and emerging forms of employment.

- Consequently, both workers and industries faced uncertainty and heavy compliance burdens.

- Therefore, the four Labour Codes were introduced to replace colonial-era structures with a simplified and modern regulatory framework.

- Ultimately, these Codes strengthen worker protection and enhance enterprise flexibility, helping build a productive, future-ready workforce.

- Together, they support a more resilient, competitive, and self-reliant Indian economy.

The key reasons behind this reform include:

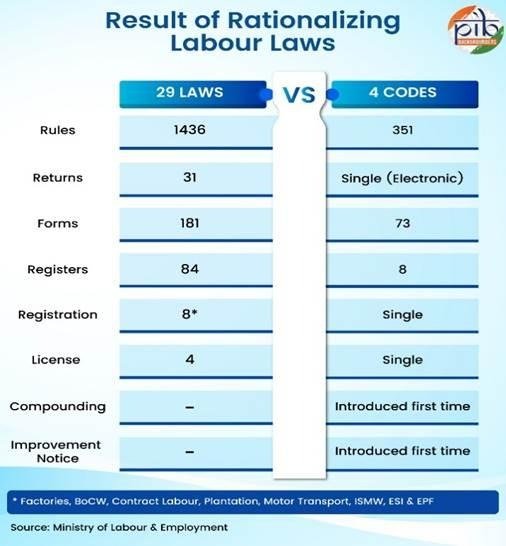

- Simplifying compliance: Multiplicity of laws leads to difficulty in compliance.

- It will streamline enforcement procedures. Multiplicity of authorities in different labour laws led to complexity and difficulty in enforcement.

- Modernizing outdated laws: Most labour legislations were framed during the pre-Independence era, necessitating alignment with today’s economic realities and technological advancements.

- Another important reason to simplify the registration, licensing framework. It will introduce the concept of a Single Registration, Single License, and Single Return, thereby reducing the overall compliance burden to spur employment.

Four Labour Codes:

The Code of Wages, 2019:

The Code of Wages, 2019 streamlines and unifies four major labour laws. These are Payment of Wages Act (1936), Minimum Wages Act (1948), Payment of Bonus Act (1965) and Equal Remuneration Act (1976). It aims to strengthen worker rights while ensuring simpler and uniform wage-related compliance for employers.

Key Highlights of the Code:

- Universal Minimum Wages: Establishes a statutory right to minimum wages for all employees in both organised and unorganised sectors. Earlier, the Minimum Wages Act covered only scheduled employment, leaving out nearly 70% of workers.

- National Floor Wage: Introduces a government determined floor wage based on minimum living standards, with regional adjustments. States cannot fix minimum wages below this benchmark, ensuring nationwide consistency and fairness.

- Rational Criteria for Fixing Wages: Minimum wages will be fixed considering skill category (unskilled, semi-skilled, skilled, highly skilled), geographic region, and working conditions such as heat, humidity or hazardous environments.

- Gender Equality in Employment: Prohibits discrimination in hiring, wages and conditions of work on the basis of gender including transgender identity for those doing similar work.

- Universal Coverage for Wage Payment: Ensures timely wage payments and restricts unauthorized deductions for all employees, removing the earlier wage-limit of ₹24,000/month.

- Mandatory Overtime Compensation: Requires employers to pay overtime at not less than twice the normal wage rate for work beyond standard hours.

- Clear Employer Responsibility: Places full responsibility for wage payment on employers – whether companies, firms or associations. Failure to pay makes the entity legally liable.

- Inspector-cum-Facilitator System: Shifts from a punitive “Inspector” model to a more collaborative “Inspector-cum-Facilitator” approach focused on guidance, awareness and improved compliance.

- Compounding of Offences: Allows compounding of first-time, non-serious offences through payment of penalties. Repeated offences within five years cannot be compounded.

- Decriminalization of Minor Offences: Replaces imprisonment for certain first-time violations with monetary fines (up to 50% of the maximum penalty), making the regulatory framework more compliance oriented and less punitive.

The Industrial Relations Code, 2020:

The Industrial Relations Code, 2020 consolidates and rationalizes three major laws. These are – Trade Unions Act, 1926, Industrial Employment (Standing Orders) Act, 1946, and Industrial Disputes Act, 1947. It modernises India’s industrial relations framework by simplifying rules on trade unions, employment conditions, and dispute resolution. The Code recognises that workers’ welfare depends on the stability and growth of industry, and aims to balance both interests.

Major Highlights of the Industrial Relations Code:

- Fixed Term Employment (FTE): Allows direct, time-bound appointments with full parity in wages and benefits. Workers become eligible for gratuity after one year. This reduces overdependence on contract labour while offering flexibility and cost efficiency to employers.

- Re-skilling Fund: Provides retrenched workers skill training support. Establishments must contribute an amount equal to 15 days’ wages per retrenched worker, credited within 45 days in addition to retrenchment compensation.

- Trade Union Recognition: A union with 51% membership becomes the Negotiating Union. If no union meets this threshold, a Negotiating Council is formed from unions with at least 20% membership. This system strengthens collective bargaining.

- Expanded Worker Definition: Includes sales promotion employees, journalists, and supervisory staff earning up to ₹18,000 per month, broadening coverage.

- Wider Definition of Industry: Covers all systematic activities involving employer – employee cooperation, irrespective of capital or profit motive. This expands labour protection.

- Higher Threshold for Lay-off/Retrenchment/Closure: Approval requirement increased from 100 to 300 workers, with states empowered to raise it further. This eases compliance and supports formalisation.

- Women’s Representation: Mandates proportional female representation in grievance committees for gender-sensitive resolution.

- Standing Orders Applicability: Threshold raised from 100 to 300 employees, reducing burdens on smaller units and allowing flexible workforce management.

- Work-from-Home Provision: Permitted in service sectors through mutual agreement, enhancing flexibility in work arrangements.

- Industrial Tribunals: Establishes two-member tribunals (judicial + administrative) to ensure faster, more balanced dispute resolution.

- Direct Tribunal Access: Parties may approach tribunals directly if conciliation fails within 90 days.

- Strike and Lockout Notice: Mandatory 14-day notice for all establishments to encourage dialogue and prevent sudden disruptions.

- Expanded Definition of Strike: Includes mass casual leave to prevent flash strikes and ensure lawful, predictable industrial action.

- Decriminalization and Compounding of Offences: Minor violations are made compoundable through monetary penalties, promoting compliance rather than prosecution.

- Digital Processes: Enables digital record-keeping, registrations, and communication to enhance transparency and efficiency.

The Code on Social Security, 2020:

The Code on Social Security, 2020 consolidates nine major social-security laws, including EPF, ESI, Maternity Benefits, Gratuity, Compensation, Construction Workers’ Cess, and Unorganised Workers’ Social Security Acts – into a unified framework.

It extends social protection to all categories of workers, including unorganised, gig, and platform workers. It will integrate digital systems and facilitator-based compliance for greater transparency and efficiency.

Major Highlights of the Social Security Code:

- Expanded ESIC Coverage: ESIC now applies nationwide, removing the earlier “notified areas” condition. Establishments with fewer than 10 workers may opt in voluntarily. Coverage is also mandated for hazardous occupations and extended to plantation workers.

- Time-bound EPF Inquiries: EPF inquiries must be initiated within five years and completed within two years (extendable by one). Suo motu reopening of cases is abolished, ensuring certainty and timely dispute closure.

- Reduced EPF Appeal Deposit: Employers now need to deposit only 25% of the assessed dues (earlier 40–70%) when appealing EPFO orders, easing financial strain and improving access to justice.

- Self-Assessment of Construction Cess:

Employers can self-assess Building and Other Construction Workers’ Cess, reducing procedural delays and minimizing official intervention. - Inclusion of Gig and Platform Workers: Defines aggregators, gig workers, and platform workers to bring them under social-security coverage. Aggregators must contribute 1% – 2% of annual turnover, capped at 5% of their payouts to such workers.

- Social Security Fund: Creates a dedicated fund to provide life, disability, health, maternity, and old-age benefits to unorganised, gig, and platform workers. Amounts from compounding of offences will also flow into this fund.

- Expanded Definition of Dependents: Coverage extended to maternal grandparents, and for female employees, dependent parents-in-law.

- Uniform Definition of Wages: “Wages” now include basic pay, dearness allowance, and retaining allowance. If exclusions exceed 50% of total remuneration, the excess must be added back, ensuring uniformity in EPF, gratuity, and pension calculations.

- Commuting Accidents Covered: Accidents during travel between home and workplace are considered employment-related for compensation purposes.

- Gratuity for Fixed-Term Employees: Fixed-term employees qualify for gratuity after one year of continuous service (earlier five years).

- Inspector-cum-Facilitator System: Introduces randomized, algorithm-based inspections and a compliance support role to ensure transparency and minimize harassment.

- Decriminalization & Monetary Penalties: Imprisonment for several offences is replaced with monetary fines. Employers must receive 30 days’ notice before legal proceedings begin.

- Compounding of Offences: First-time offences are compoundable:

- Fine-only offences → 50% of maximum fine

- Fine/imprisonment offences → 75% of maximum fine

- Digitized Compliance: Mandatory electronic maintenance of records, registers, and returns to reduce costs and improve efficiency.

- Vacancy Reporting: Employers must report vacancies to designated career centres before hiring, enhancing transparency in job opportunities.

The Occupational Safety, Health and Working Conditions (OSH&WC) Code, 2020:

The OSH&WC Code, 2020 consolidates and rationalizes provisions from 13 Central labour laws into a single framework. It aims to strike a balance between ensuring worker safety and well-being and creating a transparent, business-friendly regulatory environment that supports economic growth, formalisation, and employment generation.

Major Highlights of the OSH&WC Code:

- Unified Registration:

- Introduces a uniform threshold of 10 employees for electronic registration.

- Replaces multiple registrations with one single establishment registration, enabling a centralised database and easing business operations.

- Extension to Hazardous Work:

- Government may apply the Code to any hazardous occupation, even if only one worker is employed, ensuring stronger protection for high-risk workers.

- Simplified Compliance:

- Establishes a one licence, one registration, one return system, significantly reducing compliance burdens and procedural duplication.

- Expanded Definition of Migrant Workers:

- Inter-State Migrant Workers (ISMW) now include those employed directly, through contractors, or those who migrate on their own.

- Key benefits:

- Annual lump-sum travel allowance to native state.

- Portability of PDS and social security benefits across states.

- Access to a dedicated toll-free helpline.

- Health and Formalisation Measures:

- Free annual health check-ups for employees.

- Mandatory appointment letters specifying job details, wages, and entitlements, strengthening transparency.

- Women’s Employment:

- Women may work in all establishments, including night shifts, with consent and adequate safety arrangements – promoting equality and inclusion.

- Expanded Coverage for Media Workers:

- Definitions of working journalists and cine workers expanded to include employees in electronic media and all forms of audio-visual content production.

- National Database for Unorganised Workers:

- Establishment of a national digital database to map skills, facilitate job matching, and expand social-security access, especially for migrants.

- Victim Compensation:

- Courts may direct at least 50% of imposed fines to be paid to victims or their families in cases of workplace injury or death.

- Contract Labour Reforms:

- Applicability threshold raised from 20 to 50 contract workers.

- Contractors to receive an All-India licence valid for 5 years, with provisions for auto-generated and deemed licences.

- Contract Labour Board abolished and replaced by a designated authority to advise on core vs. non-core activities.

- Safety Committees:

- Mandatory Safety Committees in establishments with 500+ workers, ensuring joint employer-worker responsibility for workplace safety.

- National Occupational Safety & Health Advisory Board:

- A single tripartite board replaces six earlier boards to set uniform national safety standards across sectors.

- Decriminalisation & Compounding of Offences:

- Fine-only offences are compoundable at 50% of maximum fine.

- Offences involving imprisonment or fine can be compounded at 75%.

- Shifts focus from criminal penalties to civil, monetary penalties to encourage compliance.

- Revised Factory Thresholds:

- Factory applicability raised from 10 to 20 workers (with power) and 20 to 40 workers (without power), reducing burden on smaller units.

- Social Security Fund:

- Creates a dedicated fund for unorganised workers, financed through penalties and compounding fees.

- Contract Labour – Welfare and Wages:

- Principal employer responsible for ensuring health, safety, and welfare measures for contract workers.

- If contractors fail to pay wages, the principal employer must ensure wage payment.

- Working Hours & Overtime:

- Standard working hours limited to 8 hours/day and 48 hours/week.

- Overtime only with worker consent and paid at twice the regular rate.

- Inspector-cum-Facilitator System:

- Inspectors now function as facilitators, guiding employers on compliance rather than only enforcing penalties.

- Introduces tech-enabled inspections for transparency.

Comparison of Labour Ecosystem before and after the implementation of the Labour Codes:

| Pre – Labour Reforms | Post – Labour Reforms | |

| Formalisation of Employment | No mandatory appointment letters | Mandatory appointment letters to all workers. Written proof will ensure transparency, job security, and fixed employment. |

| Social Security Coverage | Limited Social Security Coverage | Under Code on Social Security, 2020 all workers including gig & platform workers to get social security coverage. All workers will get PF, ESIC, insurance, and other social security benefits. |

| Minimum Wages | Minimum wages applied only to scheduled industries/employments; large sections of workers remained uncovered | Under the Code on Wages, 2019, all workers to receive a statutory right minimum wage payment. Minimum wages and timely payment will ensure financial security. |

| Preventive Healthcare | No legal requirement for employers to provide free annual health check-ups to workers | Employers must provide all workers above the age of 40 years with a free annual health check-up. Promote timely preventive healthcare culture |

| Timely Wages | No mandatory compliance for employers payment of wages | Mandatory for employers to provide timely wages, ensuring financial stability, reducing work stress and boosting overall morale of the workers. |

| Women workforce participation | Women’s employment in night shifts and certain occupations was restricted | Women are permitted to work at night and in all types of work across all establishments, subject to their consent and required safety measures. Women will get equal opportunities to earn higher incomes – in high paying job roles. |

| ESIC coverage | ESIC coverage was limited to notified areas and specific industries; establishments with fewer than 10 employees were generally excluded, and hazardous-process units did not have uniform mandatory ESIC coverage across India | ESIC coverage and benefits are extended Pan-India – voluntary for establishments with fewer than 10 employees, and mandatory for establishments with even one employee engaged in hazardous processes. Social protection coverage will be expanded to all workers. |

| Compliance Burden | Multiple registrations, licenses and returns across various labour laws. | Single registration, PAN-India single license and single return. Simplified processes and reduction in Compliance Burden. |

Benefits of Labour Reforms Across Key Sectors:

- Fixed-Term Employees (FTE):

- FTEs receive all benefits equal to permanent workers, including leave, medical, and social security.

- Gratuity becomes payable after one year, with equal wages encouraging direct hiring and reducing contract dependence.

- Gig & Platform Workers:

- Gig and platform workers are formally recognised, with aggregators contributing 1–2% of turnover (capped at 5%) toward their social security.

- An Aadhaar-linked Universal Account Number ensures fully portable welfare benefits across states.

- Contract Workers:

- Contract workers receive benefits equal to permanent staff, including gratuity after one year.

- Principal employers must ensure health and social security coverage, plus a free annual health check-up.

- Women Workers:

- Equal pay and anti-discrimination protections ensure gender equity at the workplace.

- Women can work night shifts and in all job categories with consent and safety measures, supported by mandatory representation in grievance committees and expanded family definition.

- Youth Workers:

- Appointment letters, minimum wages, and mandatory paid leave protections promote formal employment for youth.

- Floor wage guarantees ensure a decent standard of living and prevent exploitation.

- MSME Workers:

- MSME workers receive guaranteed minimum wages and essential facilities such as canteens, drinking water, and rest areas.

- Standard working hours, paid leave, and double overtime wages ensure fair working conditions.

- Beedi & Cigar Workers:

- Minimum wages are ensured, with working hours capped at 8 – 12 hours/day and 48 hours/week.

- Overtime requires worker consent and must be paid at twice the normal wage.

- Plantation Workers:

- Plantation workers are now covered under OSHWC and Social Security Codes for safety and welfare benefits.

- Workers and families receive full ESI medical care, safety training, and education facilities for children.

- Audio-Visual & Digital Media Workers:

- Journalists, dubbing artists, and stunt performers get full benefits and mandatory appointment letters.

- Consent-based overtime is paid at double the normal rate.

- Mine Workers:

- Commuting accidents are treated as employment-related, ensuring compensation.

- Workplace standards, free health check-ups, and capped working hours enhance worker safety and well-being.

- Hazardous Industry Workers:

- All workers receive free annual health check-ups and national safety standards ensure safer workplaces.

- Women can work in hazardous roles with equal opportunities and sites must have safety committees.

- IT & ITES Workers:

- Salaries must be released by the 7th of every month, ensuring transparency and timely payments.

- Equal pay, night-shift options for women, fast grievance resolution, and social security through appointment letters are guaranteed.

- Dock Workers:

- Dock workers receive legal recognition, appointment letters, and full PF, pension, and insurance benefits.

- Employers must provide annual health check-ups, medical facilities, sanitation, and safe working conditions.

- Export Sector Workers:

- Fixed-term export workers receive gratuity, PF, and all social security benefits without wage ceilings.

- Workers can take annual leave after 180 days and enjoy timely wage payment, while women may work night shifts with strict safety protocols.

Other Key Reforms Introduced by the Four Labour Codes:

Beyond welfare enhancements, the Labour Codes introduce several structural reforms that strengthen worker protection and streamline employer compliance. These include:

- National Floor Wage to ensure no worker is paid below a uniform minimum living standard.

- Gender-neutral pay and opportunities, explicitly banning discrimination including against transgender persons.

- Inspector-cum-Facilitator system that shifts enforcement from punitive action to guidance, awareness, and compliance support.

- Faster and predictable dispute resolution through two-member Industrial Tribunals and direct access after conciliation.

- Single registration, licence and return, replacing multiple overlapping filings and reducing compliance complexity.

- National OSH Board to formulate harmonised occupational safety and health standards across industries.

- Mandatory Safety Committees in establishments with 500+ workers to strengthen workplace vigilance and accountability.

- Higher factory applicability thresholds, reducing regulatory burden on small units while retaining essential worker safeguards.

Conclusion:

India’s social-security landscape has transformed significantly over the past decade, expanding coverage from just 19% of the workforce in 2015 to over 64% in 2025. This remarkable rise has strengthened worker protection nationwide and earned global recognition for India’s progress in social welfare.

The implementation of the four Labour Codes marks the next decisive step in this journey. By widening the social-security net and ensuring portability of benefits across states and sectors, the Codes position workers particularly women, youth, unorganised, gig and migrant labour at the core of the nation’s labour governance framework.

At the same time, the Codes ease compliance, encourage flexibility and support modern work arrangements. Together, these reforms are designed to boost employment, enhance skilling and promote sustainable industry growth. Ultimately, the Labour Codes reaffirm the Government’s vision of building a labour ecosystem that is pro-worker, pro-women, pro-youth and pro-employment, strengthening the foundation for a more inclusive and future-ready economy.

Sources:

- https://labour.gov.in/sites/default/files/pib2192463.pdf

- https://www.pib.gov.in/PressReleasePage.aspx?PRID=2192524®=3&lang=2

- https://www.thehindu.com/business/Economy/labour-codes-likely-to-be-fully-operational-from-april-1-2026-govt-to-pre-publish-draft-rules-soon/article70354911.ece

- https://labour.gov.in/sites/default/files/labour_code_eng.pdf

Stay updated with national developments through Current Affairs, offering reliable insights and daily news analysis for competitive exams.

FAQ:

They are the Code on Wages (2019), Industrial Relations Code (2020), Code on Social Security (2020) and OSH&WC Code (2020).

The Codes were implemented nationally from 21 November 2025, consolidating 29 central labour laws into four codes.

They ensure minimum wages, universal social security (including gig workers), gratuity for fixed-term employees, safety checks, and faster dispute resolution.

They simplify compliance via single registration, single licence, single return, digital records, and an inspector-cum-facilitator model to ease enforcement.

Yes — the Code on Social Security and OSH&WC explicitly include gig, platform and migrant workers, with provisions for aggregator contributions and portable benefits.