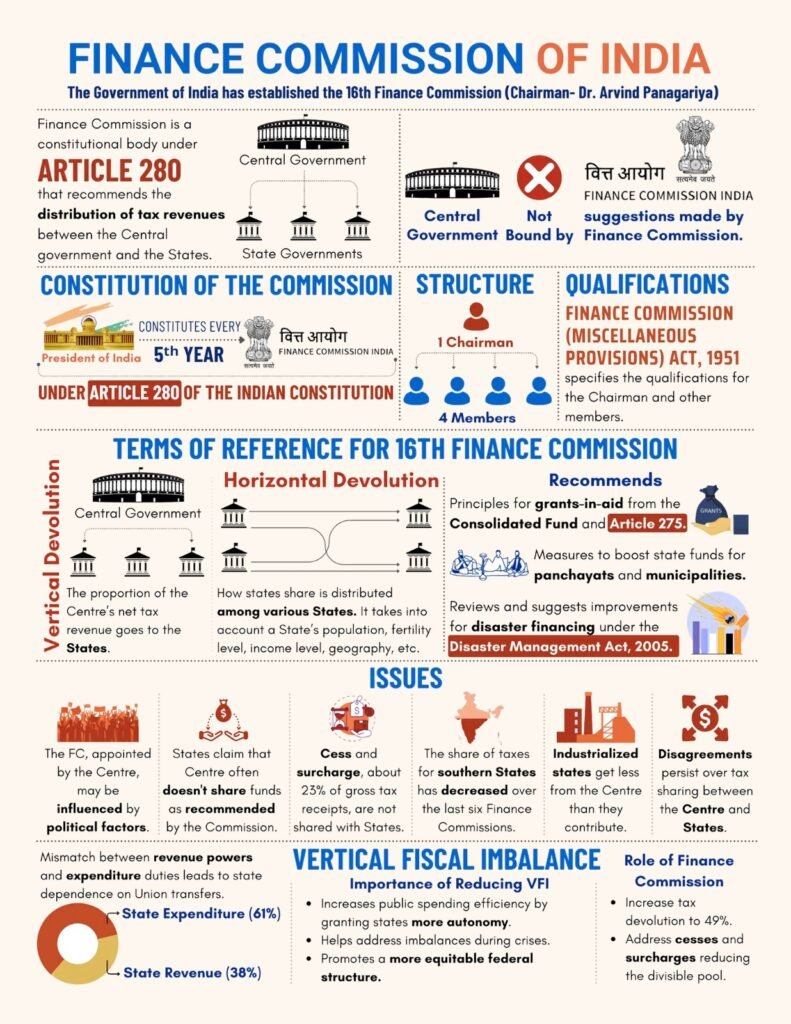

The Finance Commission of India (FCI) is an important constitutional body that ensures a fair distribution of financial resources between the central government and the states, promoting equal growth across the nation. Established under Article 280 of the Indian Constitution, it serves as a crucial mechanism for promoting balanced growth across the nation. Primarily, its role is to recommend the distribution of tax revenues among the Centre and the states. Consequently, this function is essential for facilitating public welfare and upholding the principles of fiscal federalism. Overall, the Finance Commission acts as a bridge to maintain financial harmony in India’s federal structure.

Further, understanding the FCI’s roles and challenges is important for understanding the financial governance in India, making it an important topic for those preparing for the civil service examinations, as it fits in the general studies paper II of the UPSC examination and general studies paper II or APSC mains examination.

What is Finance Commission of India?

In brief, the Finance Commission of India is a constitutional body established by the President under Article 280 of the Constitution of India. Formed every five years or as needed, it consists of a chairman and four appointed members. Primarily, the Commission’s role is to recommend the distribution of financial resources between the Union and State Governments. Additionally, it advises on grants-in-aid and addresses financial matters referred by the President. As a result, its recommendations play a vital role in reducing fiscal imbalances and ensuring that States have adequate resources to provide essential public services.

1. What is the History of the Finance Commission of India?

The Finance Commission of India was established by the constitutional body in India under Article 280 of the Indian Constitution and came into being on November 26, 1949. The first Finance Commission was constituted in 1951, with K.C. Neogy its chairman. Thereafter, two to three commissions have provided invaluable advice, which has helped shape India’s fiscal policy and the federation’s finances. The Finance Commissions now have a much greater scope of work and complexity, due to the changed economic environment. Each of the commissions faced diverse issues, notably the intersection between plan and non-plan expenditure, the implications of introducing GST, and whether the long-term fiscal sustainability of both the central and state governments would be impacted by its recommendations.

2. What are the Articles Related to FCI?

There are various articles in the Constitution of India that deal with the provisions related to the Finance Commission of India (FCI). The following table shows the key articles related to the Finance Commission of India:

| Article no. | Subject Matter |

| Article 280 | Finance Commission |

| Article 281 | Recommendations of the Finance Commission |

| Article 270 | Tax Distribution Role |

| Article 275 | Financial Support Grants |

| Article 293 | State Borrowing Recommendations |

3. What are the Members of the Finance Commission of India?

Usually, the Finance Commission of India consists of a Chairman and four other members. The President of India appoints members who are experts in all areas of public administration, finance, or economics. The President also appoints a Secretary to the Commission to assist with its operations and workings. PresiThe dent will define the length of time the chairman and members will serve, but the commission is established every five years.

The members of the 16th Finance Commission are:

a. Chairman: Arvind Panagariya, former Chief Economist of the Asian Development Bank, was appointed chairman.

b. Members: The members of the finance commission are the following:

- Shri Ajay Narayan Jha

- Smt. Annie George Mathew

- Dr. Manoj Panda

- Dr. Soumya Kanti Ghosh.

Since the members are experts in diversified fields, their suggestions on any one issue would contain every angle of fiscal and economic management.

| Position | Name | Background |

| Chairman | Arvind Panagariya | Economist and Former Vice Chairman of NITI Aayog |

| Full-Time Member | A.N. Jha | Former Expenditure Secretary and Member of the 15th Finance Commission |

| Full-Time Member | Annie George Mathew | Former Special Secretary, Department of Expenditure |

| Full-Time Member | Niranjan Rajadhyaksha | Executive Director, Artha Global |

| Part-Time Member | Soumya Kanti Ghosh | Group Chief Economic Adviser, State Bank of India |

What are the Qualifications of the Members of the Finance Commission?

Moreover, the Constitution empowers the Parliament to prescribe the qualifications of the members of the Commission. In addition, the Parliament has passed the Finance Commission Act of 1951, whereby the qualifications of the members of the Finance Commission are as follows:

- The Chairman shall be a person having experience in public affairs.

- Other than Chairman, four members shall be appointed from the following persons:

- a judge of the High Court or a person qualified to be appointed as such.

- a person having special knowledge of government finance and government accounts.

- a person with experience in financial matters and administration.

- a person with special knowledge of economics.

4. What are the Functions of the Finance Commission of India?

The Finance Commission of India plays an important role in our country’s financial system. The main functions of Finance Commission include:

- The Finance Commission of India is crucial for maintaining financial stability and equitable resource distribution between the Centre and the States.

- It makes recommendations to the President on key matters, including:

- Distribution of net tax proceeds between the Centre and the States.

- Allocation of respective shares among the States.

- In addition, establishes principles for grants-in-aid from the Centre to the States to address fiscal disparities and promote balanced development.

- Also, examines the financial positions of central and state governments, suggesting measures for:

- Fiscal consolidation.

- Efficient debt management to ensure stability.

- Assesses the financial needs of local governments and recommends ways to strengthen their financial resources.

- Remains open to addressing other matters referred by the President for sound financial management.

5. What are the Roles of the Finance Commission of India?

The Finance Commission of India‘s contributions to the country’s fiscal architecture. Below is the list of the role of FCI:

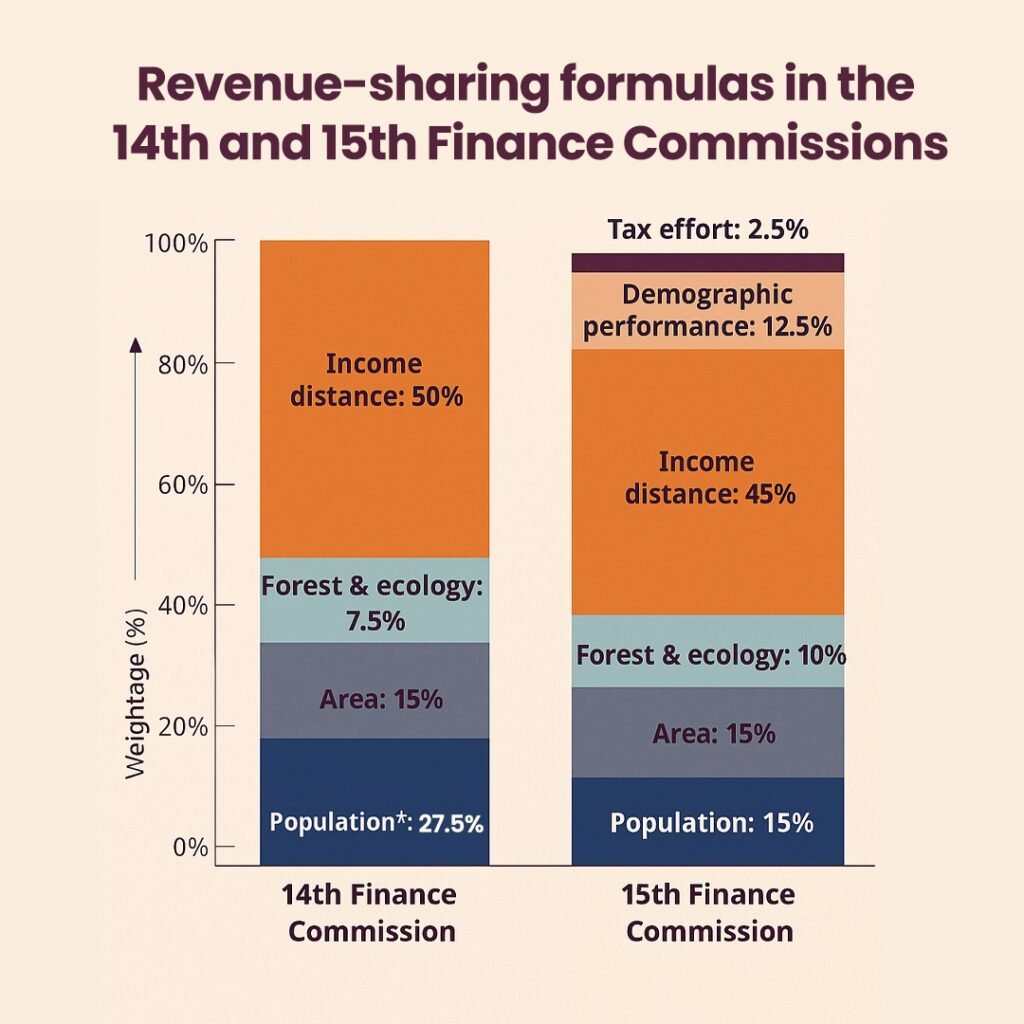

1. Equitable Distribution of Resources: In suggesting the manner in which the revenues shall be distributed between the Centre and states and between the states, the Finance Commission APSC takes into account factors such as population, area, economic backwardness, etc., to ensure better equity in how the country’s resources are distributed.

2. Promotes Social Welfare: In addition, the Commission recommends principles that govern the grants-in-aid to states that are unable to generate sufficient revenue by themselves to provide essential services covering health, education, and infrastructure. By addressing fiscal imbalances, the Commission’s recommendations ultimately promote and enhance overall social welfare across the country.

3. Empowers State Governments: Coupled with financial empowerment regarding resources, it enables state governments the frees themselves from undue control in how funds are appropriated. The financial empowerment of the states is the final theatre of government.

4. Local Self-Government Strengthened: It also proposes measures to strengthen the Consolidated Funds of the states to contribute to the resources of the local bodies and to empower them to undertake their constitutionally required functions.

5. Federalism Strengthened: Further, the commission encourages central and state government cooperation on financial decisions, thereby enhancing a federal environment.

6. Fiscal Consolidation and Discipline: The commission’s recommendations, by establishing the linchpin for a stable and sustainable fiscal environment, promote fiscal stability and fiscal management at the central and state level and, accordingly, sound economic growth.

7. Incentivising Reforms: Moreover, by providing linkages between fiscal allocations and reforms, the Commission encourages states to embrace successful reforms that lead to improved governance and service delivery.

8. Addressing Changing Contemporary Needs: The commission also assists in responding to contemporary fiscal matters or changing economic conditions. For instance, the nature in which new financial arrangements and policies, such as the goods and services tax (GST), have been introduced.

What is the List of the Finance Commission of India?

The information shows the finance commissions formed in India with their chairman and the dates of establishment.

| List of Finance Commissions in India | ||

| Finance Commission | Chairman | Tenure |

| First Finance Commission | K.C. Neogy | 1951-1952 |

| Second Finance Commission | K. Santhanam | 1956-1957 |

| Third Finance Commission | A.K. Chanda | 1960-1961 |

| Fourth Finance Commission | P.V. Rajamannar | 1964-1966 |

| Fifth Finance Commission | Mahavir Tyagi | 1968-1969 |

| Sixth Finance Commission | K. Brahmananda Reddy | 1972-1974 |

| Seventh Finance Commission | J.M. Shelat | 1977-1979 |

| Eighth Finance Commission | Y.B. Chavan | 1984-1989 |

| Ninth Finance Commission | N.K.P. Salve | 1989-1995 |

| Tenth Finance Commission | V. Ramakrishna | 1995-2000 |

| Eleventh Finance Commission | A.M. Khusro | 2000-2005 |

| Twelfth Finance Commission | C. Rangarajan | 2005-2010 |

| Thirteenth Finance Commission | Vijay L. Kelkar | 2010-2015 |

| Fourteenth Finance Commission | Y.V. Reddy | 2015-2020 |

| Fifteenth Finance Commission | N.K. Singh | 2020-2025 |

| Sixteenth Finance Commission | Arvind Panagariya | 2025-2030 |

What is the State Finance Commission?

- Constitutional Foundation: The 73rd and 74th Amendments to the Constitution, introduced in 1992, aimed at constitutionalising Panchayati Raj Institutions and Municipalities in India. By doing so, they reinforced the idea of local self-governance, ensuring that governance reaches the grassroots level. These amendments, therefore, provided a constitutional status to local bodies, thereby clearly defining their structure, powers, responsibilities, and tenure. As a result, they significantly promote decentralised and participatory democracy. Furthermore, this framework encourages greater community involvement and accountability, which ultimately strengthens democratic governance at all levels.

- Appointment: Under Article 243-I of the Constitution, the Governor of each state appoints the State Finance Commission every five years.

- Functions: Financial Examination, Distribution of Resources, Grants, and Assistance, Disaster Management, Formulation of Recommendations.

What is the 16th Finance Commission of India?

The Government of India has constituted the 16th Finance Commission as provided in Article 280 (1) of the Constitution of India, with Dr. Arvind Panagariya being appointed as Chairperson.

1. Terms of Reference for the 16th Finance Commission

- In the first place, the Distribution of taxes between the Union and States and the allocation of State shares.

- The principles which will govern grants in aid to States from the Consolidated Fund of India, as well as grants under Article 275 (gives power to Parliament to make laws to provide financial assistance to States through grants-in-aid for specific purposes).

- Similarly, measures to enhance the State Consolidated Funds to support the Panchayats and Municipalities based on the recommendations of the State Finance Commission.

- Additionally, review the financing mechanisms relating to disaster financing in terms of the Disaster Management Act, 2005, and suggest enhancements/changes in the structure.

2. Mandate of the 16th Finance Commission of India

- Historical Function: Since it was established in 1951, the FC has concentrated on equitable resource redistributions through vertical & horizontal allocations, to relatively less developed states.

- Tax Revenue Sharing: It also recommends how to share the revenue collected in the form of taxes between the Union government and the states for the five-year period commencing on 1st April 2026.

- Grants-in-aid: Further, recommend the principles of grants-in-aid made by the Consolidated Fund of India to states.

- Urban Local Government: Recognise and encourage their contribution to economic development, and increase allocations to them.

- Higher than Fiscal Arithmetic: Role of the FC is to lay out a vision for a future where all States contribute to national growth, while managing the consequences of trends (urbanisation, climate resilience)

- Disaster Management: Propose reforms to the financing arrangements & structures linked to disaster management.

- Climate Change: Recommend & finance climate mitigation & adaptation budgets.

- Fiscal Discipline: Provide advice on fiscal discipline and public expenditure.

- Impact on Growth: FC decisions will impact millions with respect to their livelihoods and the great sport of India achieving the status of a leading global economy.

What is the Way Forward?

The recommendations of the PV Rajamannar Committee highlight several key areas for strengthening the effectiveness of the UPSC Indian Polity Finance Commission.

1. Permanence: The committee advocates for making the Commission a permanent body to ensure continuous oversight and responsiveness to the nation’s evolving needs.

2. Strengthening Capacity: Enhancing the Commission’s analytical and advisory capabilities is vital. This can be achieved by leveraging reliable data sources, employing robust methodologies, and engaging effectively with experts and stakeholders.

3. Enhanced Consultation: Improving communication and outreach strategies is essential for widely disseminating reports, soliciting feedback, and fostering consensus among stakeholders.

4. Promotion of Cooperative & Competitive Federalism: The Commission should explore innovative approaches to promote both cooperative and competitive federalism, enabling adaptation to emerging realities.

5. Addressing Emerging Issues: The Commission must remain proactive in responding to challenges presented by GST implementation, the Covid-19 pandemic, climate change, and digital transformation, reflecting the evolving economic and social dynamics.

6. Enhanced Resource Allocation: By utilizing a performance-based resource allocation process, a unified and effective national growth process will allow States to take the lead.

7. Urban and Demographic Strategies: Allocating resources for urban infrastructure and demographic adjustments is crucial to ensuring that progressive States like Tamil Nadu continue to be growth engines.

8. Balanced Strategy: A dual focus on expanding the national economy while ensuring equitable distribution of benefits among all States will allow progressive States to keep driving growth.

9. Strengthening Policy Frameworks: A balanced distribution policy, complemented by targeted support for high-performing States, will foster sustained economic development across India.

By implementing these recommendations, the Finance Commission of India can enhance its role in driving growth and development while ensuring that all States contribute to and benefit from national progress. This approach promotes equitable resource distribution and fosters sustainable development, leading to improved collaboration among States and strengthening the overall economic landscape.

Conclusion

In conclusion, the Finance Commission of India plays an important role in fiscal federalism, helping to ensure appropriate financial resource allocation between Union and State Governments. The constitutional body in India will continue to be important as India moves forward with its strong focus on economic growth and social development. Any steps taken towards resolving the challenges facing it will contribute significantly to balanced regional development and to the financial stability of the country.

Frequently Asked Questions

Ans: The President of India constitutes the Finance Commission of India.

Ans: The Governor constitutes the Finance Commission for a State.

Some of the successful recommendations of the Finance Commission are as follows:

● Introduce tax devolution to increase states’ share from 10% to 42% over time.

● Implement performance-based incentives for states to promote fiscal discipline and efficient governance.

● Establish disaster relief funds for states and local bodies to aid in preparedness and mitigation.

● Allocate grants to enhance local bodies’ service delivery and infrastructure, promoting fiscal autonomy and accountability.

Ans: The Finance Commission is a constitutional body in India established to define the financial relationship between the central government and the state governments.

Ans: Yes, the Finance Commission is a constitutional body established under Article 280 of the Indian Constitution

Ans: The key article related to the Finance Commission is Article 280 of the Constitution, which outlines its establishment, composition, and duties. Additionally, Articles 268 to 281 broadly address the distribution of financial resources between the Centre and the states.

Ans: As of now, the Chairman of the 15th Finance Commission is Arvind Panagariya.

Ans: Recommendations of the Finance Commission are purely advisory in nature. Therefore, it is the prerogative of the President and the Union Government to make their own judgement whether to accept, reject or modify those recommendations.

Ans: The Finance Commission ensures a balanced fiscal federalism in India by recommending the distribution of net proceeds of taxes between the Centre and the States, and among the States.

Ans: Yes, under Article 275 of the Constitution, the Finance Commission has the power to recommend grants-in-aid to the states from the Consolidated Fund of India for any specific purposes.

Ans: The Chairman and the members of the Finance Commission are appointed by the President of India.

Ans: The Finance Commission is established every five years. However, it can also be constituted earlier, as per the needs of the President of India.